Schritt-für-Schritt-Anleitung: Verbinden Sie Ihr SMACC-Konto mit DATEV

Um SMACC erfolgreich mit DATEV zu verbinden, ist es wichtig, alle aufgeführten Schritte abzuschließen. Bitte nehmen Sie sich Zeit und führen Sie die Schritte nacheinander durch. Bitte beachten Sie: Möglicherweise benötigen Sie die Hilfe Ihres Steuerberaters, wenn Sie nicht über alle erforderlichen Berechtigungen in DATEV verfügen.

-

DATEV Unternehmen Online

Wenn Sie DATEV Unternehmen Online (DUO) noch nicht nutzen, müssen Sie diese Anwendung zunächst bestellen, um SMACC mit DATEV zu verbinden. Die Schnittstelle funktioniert nur mit der Anwendung Datev Unternehmen online. DATEV App Store

-

DATEV Rechnungsdatenservice 1.0

Holen Sie sich Berechtigungen für DATEV Rechnungsdatenservice 1.0. Sie können das Produkt Rechnungsdatenservice 1.0 direkt am DATEV-Arbeitsplatz aktivieren. Befolgen Sie zur Aktivierung die Anweisungen von Datev Hinweis: Dieser Schritt muss möglicherweise von Ihrem Steuerberater durchgeführt werden. Berechtigungen für Rechnungsdatenservice 1.0

-

Erweiterte Einstellungen für Eingangsrechnungen in DUO aktivieren

-

Einstellungen für Lieferantenrechnungen

- Öffnen Sie Datev Unternehmen Online (DUO)

-

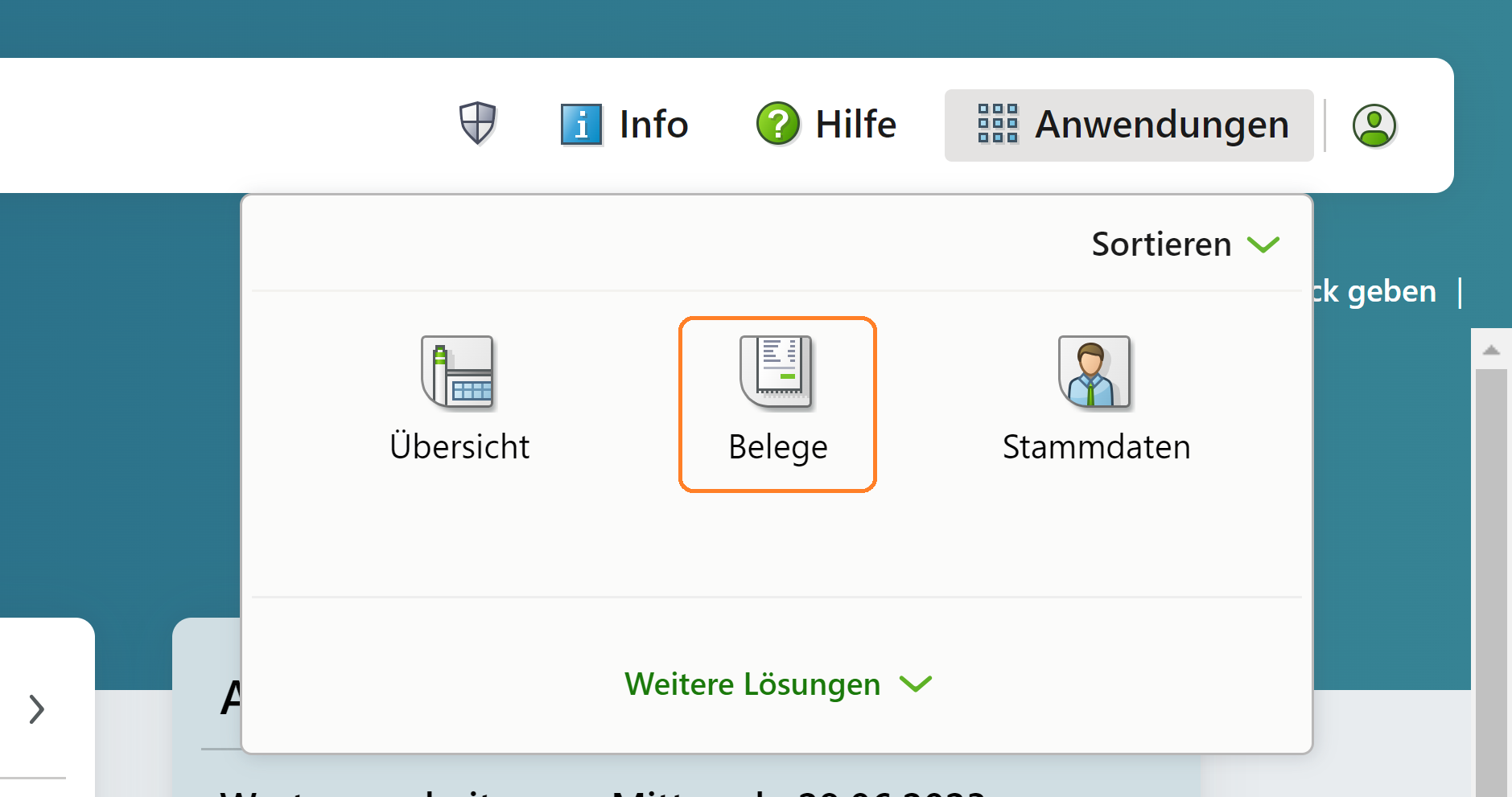

Wählen Sie die Kategorie „Dokumente“

-

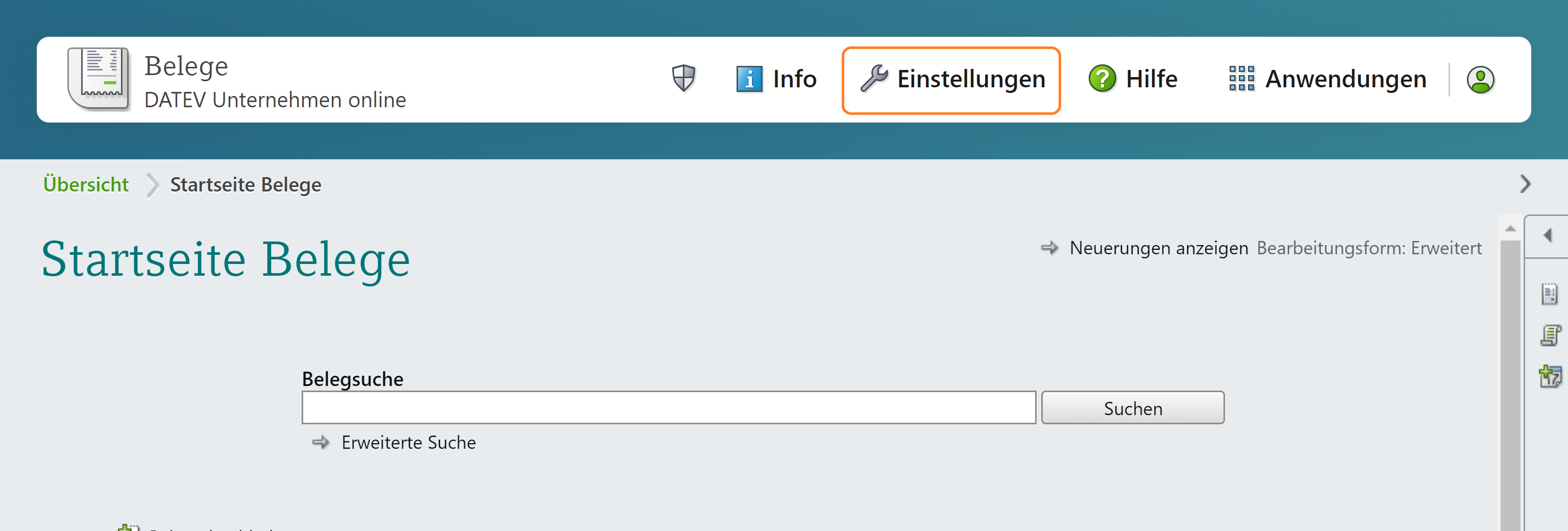

Klicken Sie auf „Einstellungen“

-

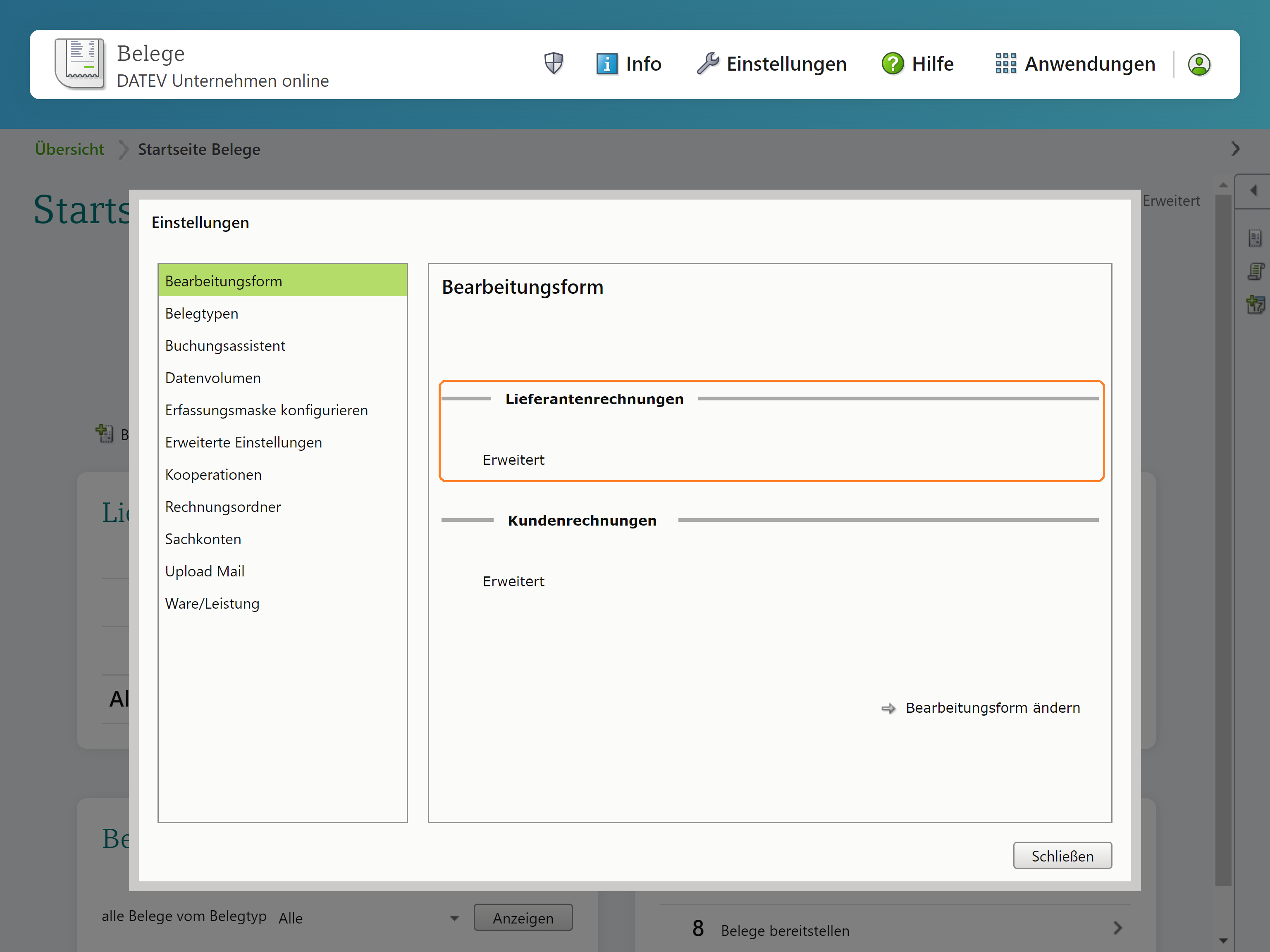

Das Bearbeitungsformular für Lieferantenrechnungen muss auf „erweitert“ eingestellt sein

-

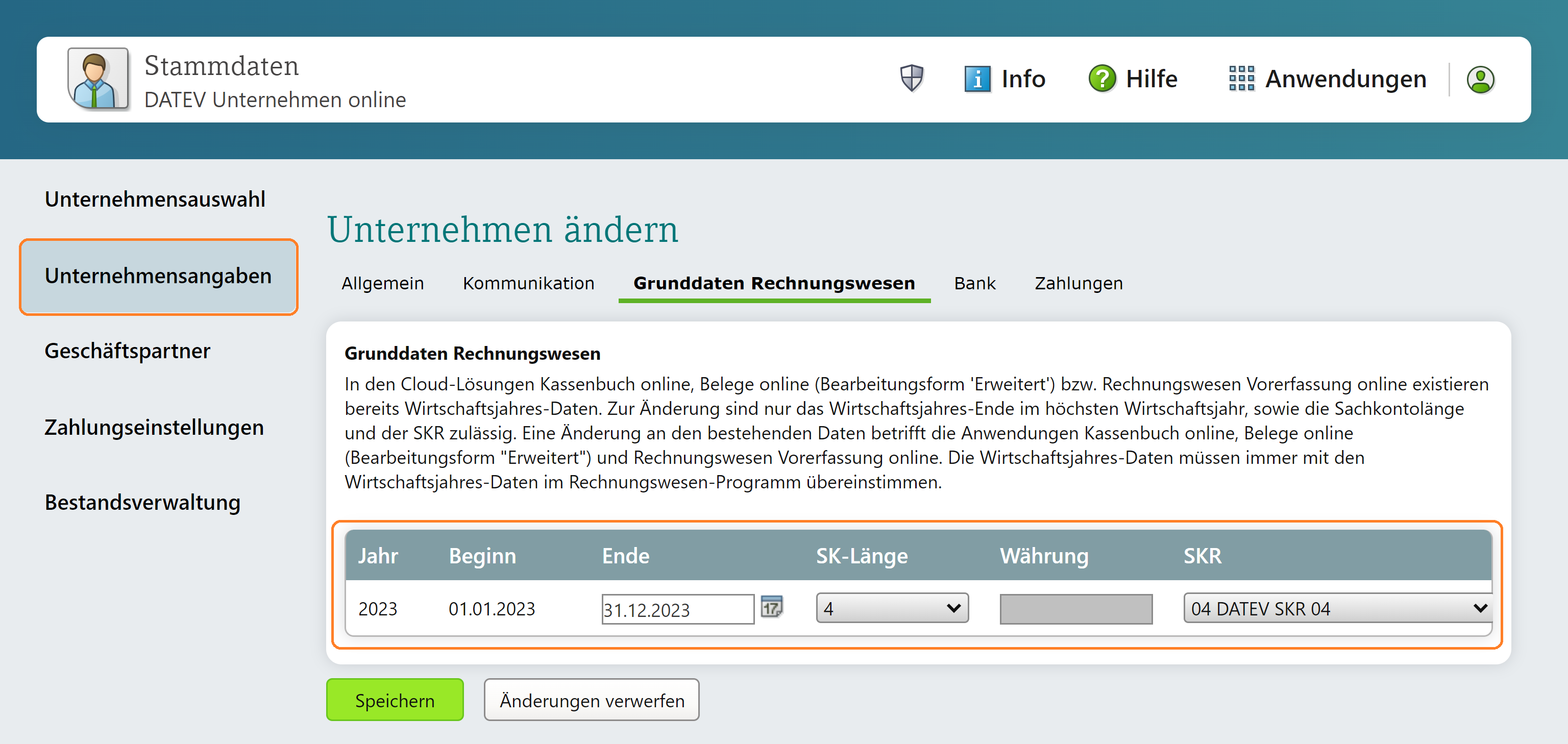

Einstellungen Stammdaten

- Öffnen Sie Datev Unternehmen Online (DUO)

-

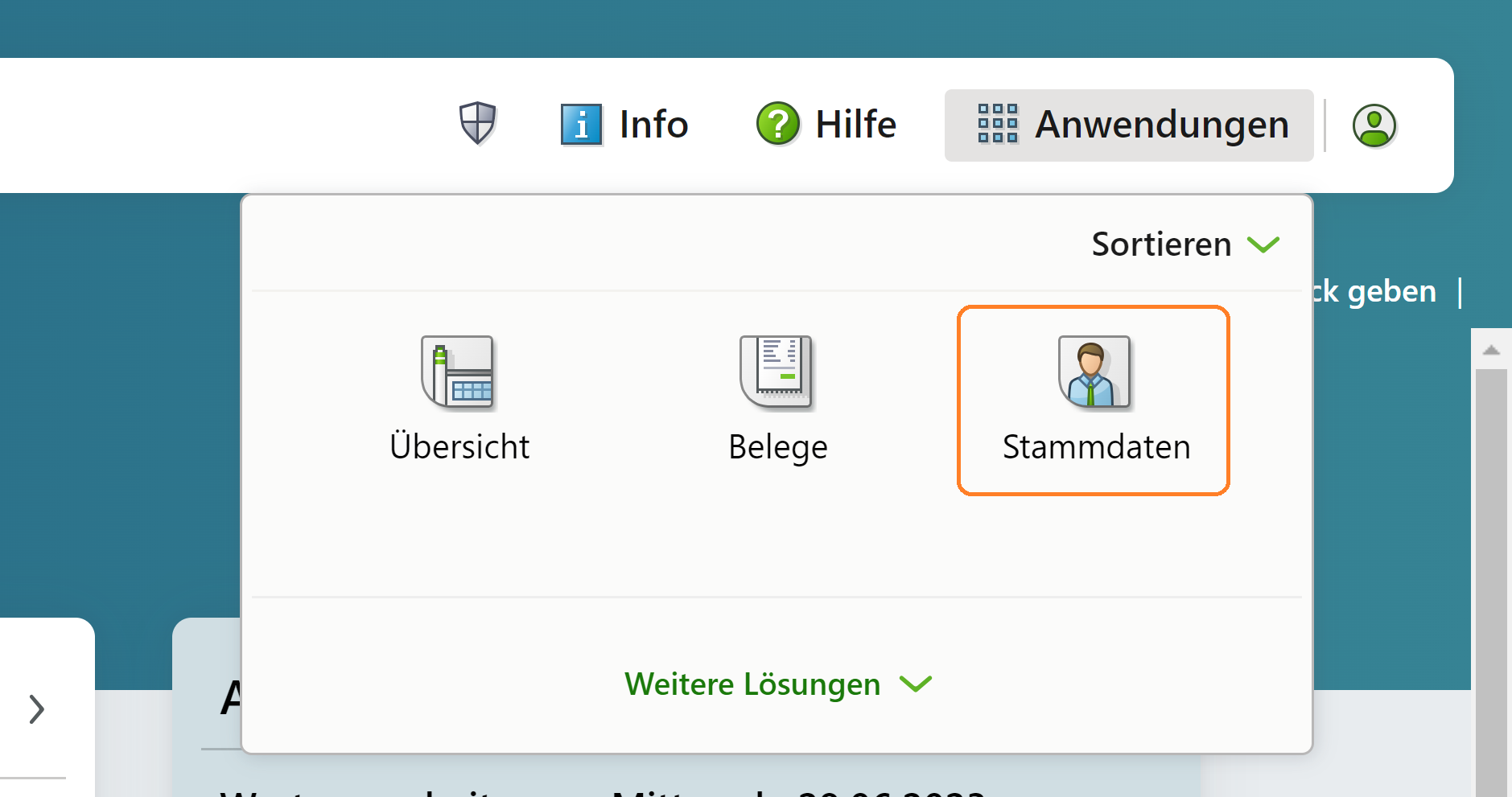

Wählen Sie im Menü „Anwendungen“ die Kategorie „Stammdaten“.

-

Klicken Sie auf „Firmendetails“

- Das Geschäftsjahr, die FIBU-Kontolänge und der Kontenplan müssen eingegeben werden Hinweis: Die Informationen müssen mit den Informationen in Ihrem SMACC-Firmenprofil übereinstimmen.

-

Einstellungen für Lieferantenrechnungen

-

Verbinden mit DATEV

Starten Sie nun im SMACC unter Einstellungen -> Firma -> Zahlung (Tab: DATEV Einstellungen) den Verbindungsvorgang mit Klick auf Mit Datev Schnittstelle verbinden

Hinweis: Wenn alles richtig eingerichtet ist und SMACC mit DATEV verbunden ist, werden folgende Exporte automatisch an DATEV übertragen, ohne dass die generierte ZIP-Datei heruntergeladen und importiert werden muss.